The Crippling Decline in Disposable Household Income

By Steven Tripp

“We’ve come a long way, we’ve got a lot going for us, we’re better placed and better prepared than other countries.”

This was the bold claim made by Treasurer Jim Chalmers at the National Press Club back in June.

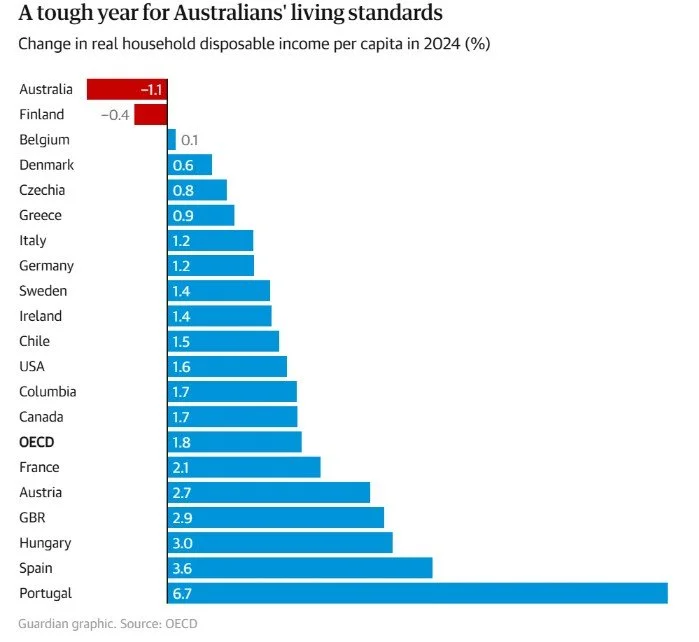

His words have come back to bite him however, as new data from the Organisation for Economic Co-operation and Development (OECD) has revealed that Australia has recorded the steepest decline in real household disposable income among all other developed nations.

According to the latest quarterly national accounts and OECD benchmarks, real per capita household disposable income fell by 1.8% in Australia in 2024. This places Australia as the only OECD ranked country that saw declines in both 2023 and 2024.

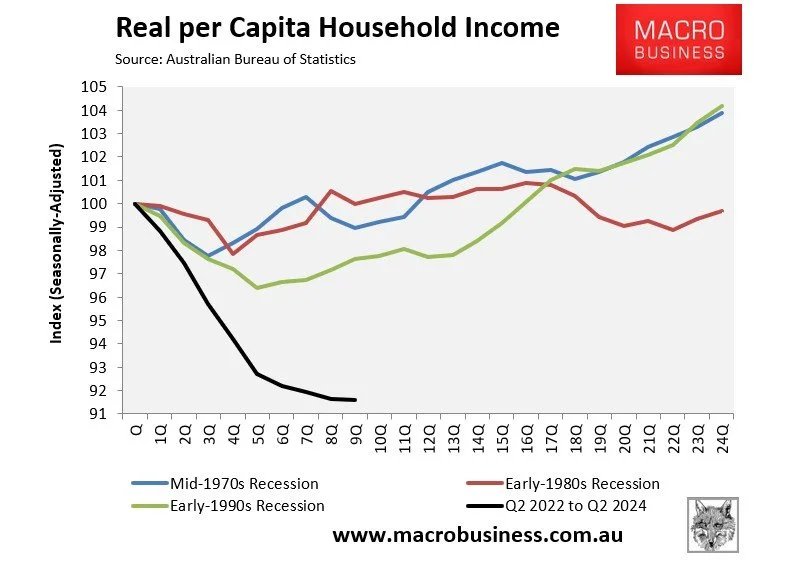

In fact, the data only adds to a prolonged slump, with real per capita household disposable incomes plummeting around 8% from their mid-2022 peak according to data from the Australian Bureau of Statistics (ABS).

Since Q4 2019, Australia's real per capita household disposable income has barely risen by only 0.1%, whereas the OECD average increased by 9.3%. This includes, Canada, the United States, and the United Kingdom, which saw increases of 5.5%, 8.6%, and 2.5% respectively.

These worrying disposable income figures indicate the underlying structural challenges in Australia's economy, with factors such as low productivity growth and diminishing returns from trade also playing their part in Australia’s overall economic outlook.

Long gone are the days of sound economic management, which saw Australia successfully absorb financial shocks from around the world. Diverging from this post-pandemic, Australia’s recovery has dragged significantly behind our global peers.

While many OECD countries rebounded with wage growth and moderating inflation, Australia's experience has been marred by persistent cost-of-living pressures, soaring energy prices, and unrealistic housing affordability.

Housing, in particular, is crippling Australians, as the country suffers from among the world's highest median home prices, with Sydney surging to a record high of $1.7 million. To make matters worse, housing affordability has coupled with higher interest rates — peaking with the Reserve Bank’s cash rate at 4.35% in late 2023, which held until February 2025, further eroding purchasing power.

Alarmingly, real wages stagnated or declined for much of 2023-2024, falling to a 14-year low, as inflation pressures continued.

Mental health surveys from Beyond Blue indicate rising financial stress, with the 2024 Mental Health and Wellbeing Check reporting that 46% of respondents named financial pressure as a key factor in their distress.

The OECD data should serve as a wake-up call for Federal policymakers. As global headwinds persist, the impact of poor domestic economic management is being felt more than ever.

Reclaiming household financial security is not just an economic imperative; it's the bedrock of national resilience. If Treasurer Chalmers truly believes we have come a long way, then we have much further to go.

By Steven Tripp